Half of Americans Are Retiring Involuntarily

Flip a coin. According to a new survey of older Americans, that’s the probability of whether it’ll be your decision—or someone else’s— about when it’s time to retire.

Employers participate in the Certified Age-Friendly Employer (CAFE) Program to attract and retain staff, and round out their DE&I programs to include age.

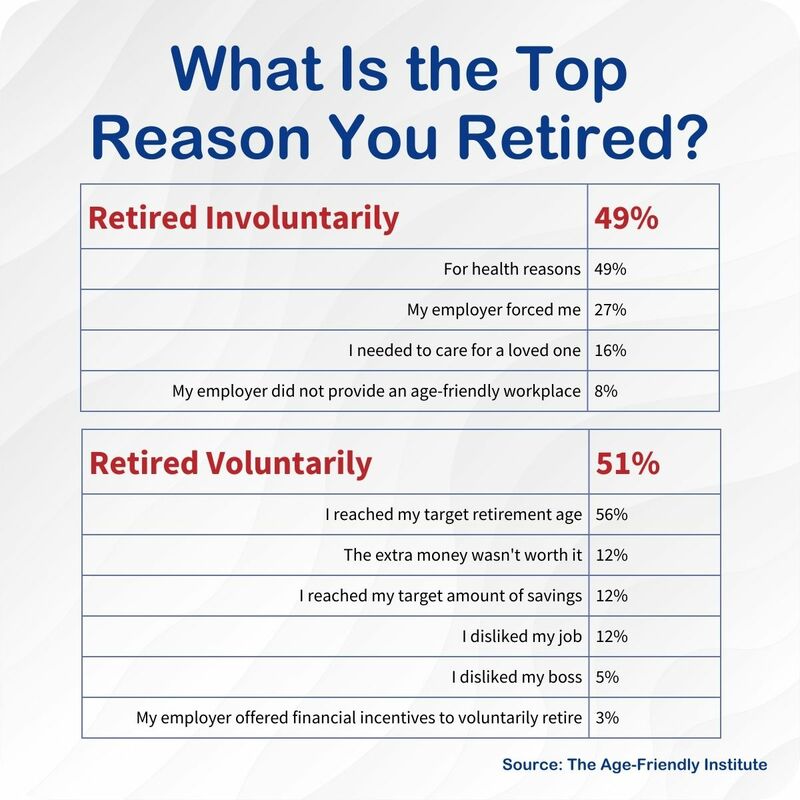

It’s a virtual toss-up. In a nationwide Age-Friendly Institute survey, retired and semi-retired Americans were asked what prompted their retirement. Half responded with answers indicating the timing was not their choice, while half indicated it was “just time”, they’d reached their target retirement age or another reason they’d pulled the trigger themselves. Among those who retired involuntarily, the leading reason they cited is declining health, followed by “my employer forced me”, “I needed to care for a loved one” and “my employer did not provide an age-friendly workplace”.

Phased retirement, though seldom formally offered by employers, is popular with individuals. When asked what would have convinced them to stay on the job longer, phased retirement, defined as working fewer hours before retiring completely, topped voluntary retirees’ lists. 28% say this would have kept them on board longer. Despite discussion of employer-initiated phased retirement programs coming online, retirees are skeptical. Asked whether they have seen such programs offered in their workplaces, most responded “no”. One survey respondent commented “my perception is you gradually phase out of full-time work without losing income and benefits, while you gradually phase into full retirement. However, I have never seen it offered. All employers want you out ASAP so they can replace you with younger and cheaper workers.”

Another respondent cited age discrimination, saying “It's so backwards! When you approach a certain age during your employment, management wants you to retire. But after you retire, there are companies who classify older workers as more reliable!”. Individuals are taking up phased retirement themselves. This includes becoming self-employed, developing “gig” or temporary assignments, and trying out new, less stressful occupations.

For those fortunate enough to call their own shots, the majority said they’d reached their target retirement age. A common response was along the lines of “it was just time”. One respondent noted “I just reached the point where time was more important to me than money.”

“Much of this comes down to time, and how people want to spend it as the get older. Employers should be thinking about how to make their schedules flexible and their cultures more age-friendly,” said Deb Nielsen, a certifier with the Age-Friendly Institute’s Certified Age-Friendly Employer (CAFE) program. “Employees would prefer a phased retirement. Ultimately they’re seeking expressions of respect, that their years of service and loyalty were valued.”

Given the uncertainty, it never hurts to save more and invest wisely in case forced retirement happens to you. Historically, studies have shown a substantially higher percentage of older adults pushed into retirement. Analysis in 2018 by ProPublica and the Urban Institute, a Washington, DC-based think tank, revealed more than half of older U.S. workers were forced out of longtime jobs before they chose to retire. Their research was based upon data from the Health and Retirement Study, the premier source of quantitative information about aging in America. Since 1992, the study has followed a nationally representative sample of about 20,000 people from the time they turn 50 through the rest of their lives.

There are no comments for this article yet. Be the first to leave a comment