The impacts of marriage on finances for older Americans

The choice to marry and divorce is a complicated one for anyone and rarely entered into lightly. We asked our survey panel of older adults for their opinions and experiences regarding these decisions.

For most, considerations of how this choice may impact long term finances probably comes low on the list. Although divorce rates are declining, Americans are living longer, increasing the possibility that they may lose their partner either due to death or the dissolution of their marriage.

Divorce or the loss of a partner can lead to the loss of assets, increased living expenses, impacts on social security income, healthcare costs, reduced income with less time to recover and the need to delay retirement or return to work.

The impact of these losses can present significant financial challenges, particularly if the person concerned has left finances in the hands of their partner.

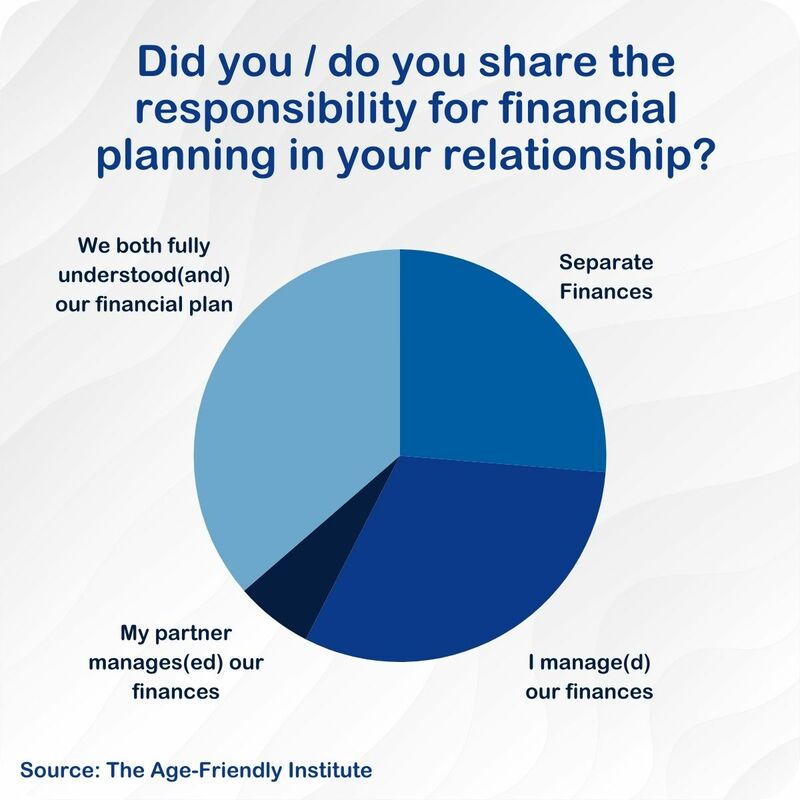

65% of currently and previously partnered survey respondents indicated that they had chosen to pool their finances though interestingly only 36% said that both partners have a full understanding of their shared financial plan.

Not surprisingly the majority (62%) of divorced participants experienced a decrease in their standard living as well as their accumulated assets (59%). Knowing the potential impact of divorce on finances only 2% of survey participants indicated that they had a prenuptial agreement which dictated the financial terms of the dissolution of their marriage. Similarly only 32% of respondents said that the potential impact of finances played a strong role in their decision on whether to divorce or to stay married longer than they wanted to, proving that these kinds of decisions remain more focused on emotion than logic.

When asked what they wished they had done differently to better plan for the financial impacts of potentially losing their partner most said they wished they had saved more, contacted a financial planner earlier or had their own financial plan, made a budget, completed their education or made better job decisions.

Some participants who lost their partners chose to remarry and of these most said that this restored or improved their prior wealth and/or standard of living 68%).

When asked what changes were made after the loss of a partner the list was long. The largest changes were seen in downsizing or changes in living arrangements, returning to work/increased hours or delayed retirement. Other changes were more mundane such as meeting with retirement planners and accountants, updates to wills, estate planning and healthcare.

Most people don’t plan for the loss of a partner. The process to recover and return to financial stability is challenging, usually requiring change and help. Working with professionals can help to get back on track and feel more comfortable with both understanding and stability.

There are no comments for this article yet. Be the first to leave a comment