How Older Americans Are Managing Healthcare Costs and Staying Healthy

The cost of healthcare is one that preoccupies Americans across the board. As the Baby Boomer generation continues to retire, the demand for healthcare services is increasing, putting additional strain on public and private healthcare funding systems.

Understanding these costs and incorporating them into a financial plan can be confusing and worrisome, especially when cost is unknown and potentially changeable.

The Age-Friendly Institute polled our survey audience surrounding their health and what role this plays in their financial plan. Upwards of 80% of participants overall said their health was currently good, only dropping to 70% when we looked at participants aged 75 and above. Over 70% credit this good health in large part to preventative healthcare, regular exercise and a healthy diet, also noting that regularly taking their medications and vitamins, mental and good sleep habits and maintaining strong social connections play a strong role.

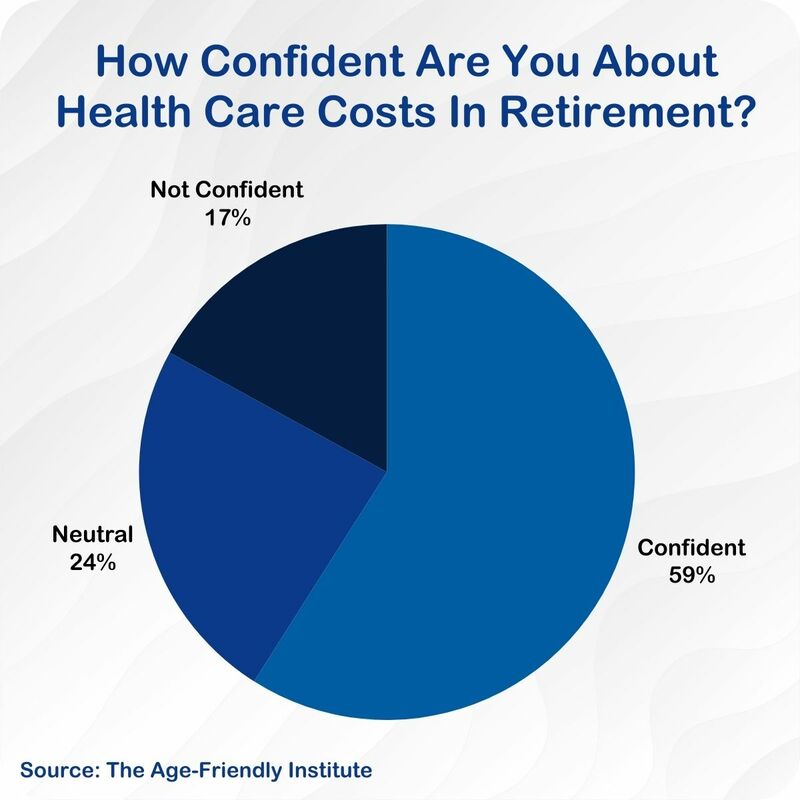

Even with a sense of current good health and what got them there, only 59% of participants felt confident that they understand their potential healthcare costs and less than half said they were confident they could afford their potential expenses. With this in mind 56% said they did not actively plan for healthcare costs in retirement and 82% said they did not receive any professional assistance in planning how they would fund their healthcare costs as a part of their overall financial plan.

Uncertainty about declining health and the associated costs have older Americans troubled. When asked what their biggest concerns were we heard many mention the possibility of needing to fund long term care, surgery or a catastrophic illness. Many were concerned about changes to Medicare and rising costs:

“The healthcare system overall and the GOP dismantling of Medicare/Social Security”

“That I will not be able to afford assisted living expenses when I reach that stage unless that facility takes Medicare.”

“Healthcare costs are on the rise and there is uncertainty about both social security and Medicare solvency.”

“Whether I will have social security or enough savings to help pay for what I need when Medicare doesn't cover it.”

The majority of older Americans are planning to rely on Medicare to fund their healthcare with 44% supplementing with private medicare supplement healthcare and much smaller numbers having access to retiree healthcare, long term care insurance or HSAs.

As the number of retirees grows, Medicare will face financial pressure. Projections show that the Medicare Trust Fund could be depleted in the next decade unless reforms are made. Where there is a gap, 52% plan to fill it with money from Social Security or other retirement funds to pay for premiums, copays, and out-of-pocket medical expenses.

Financial planning to cover healthcare expenses in retirement is essential to ensure that older adults can maintain a good quality of life without being overwhelmed by medical costs. As healthcare expenses can be significant and unpredictable, it’s important to start planning early and use various strategies to manage costs effectively.

- Estimate Healthcare Costs in Retirement

- Maximize Health Savings Accounts (HSAs)

- Consider Long-Term Care Insurance

- Build a Retirement Fund with Healthcare in Mind

- Choose the Right Medicare Plan

- Consider a Retirement Healthcare Fund

- Plan for Out-of-Pocket Costs

- Prepare for Unexpected Healthcare Expenses

- Understand the Role of Medicaid

- Regularly Review and Adjust Your Plan

To adequately cover healthcare expenses in retirement, it’s important to plan early, understand the costs, and use various tools and strategies like HSAs, long-term care insurance, Medicare, and dedicated savings accounts. By making proactive financial decisions, working with a financial professional and staying informed about available options, the burden of healthcare expenses can be reduced and a more financially secure retirement can be achieved.

There are no comments for this article yet. Be the first to leave a comment