A Social Security Pulse Check for Older Americans

The rising cost of living and concerns about the stability and longevity of programs designed to support the health and well-being of older Americans are big concerns for those planning their financial futures. The Age-Friendly Institute polled our survey panel of older adults surrounding their finances and how Social Security plays into those plans.

The question of when to file makes a big difference in how much social security is received on a monthly basis along with how many years were worked and what compensation was accrued during those years.

Some choose to file before the age of 65 due to financial necessity or health challenges. Starting to collect at 62, the earliest possible age, means benefits are permanently reduced which can be as much as 30% less than the full benefit amount. Most of our survey participants were distributed with those starting to collect at 65 and 66 and spiking up again at 70 for those who chose to wait as long as possible and maximize monthly payment amounts. Choosing to start collecting after full retirement age will increase the benefit amount by 8% per year until the age of 70.

Regardless of when they started to collect, 60% of participants felt they filed at the right time with 37% wishing they had waited until later (just a point lower than when we last asked this question). 66% felt they had or have the right information to make this choice, down from 79% in our last survey.

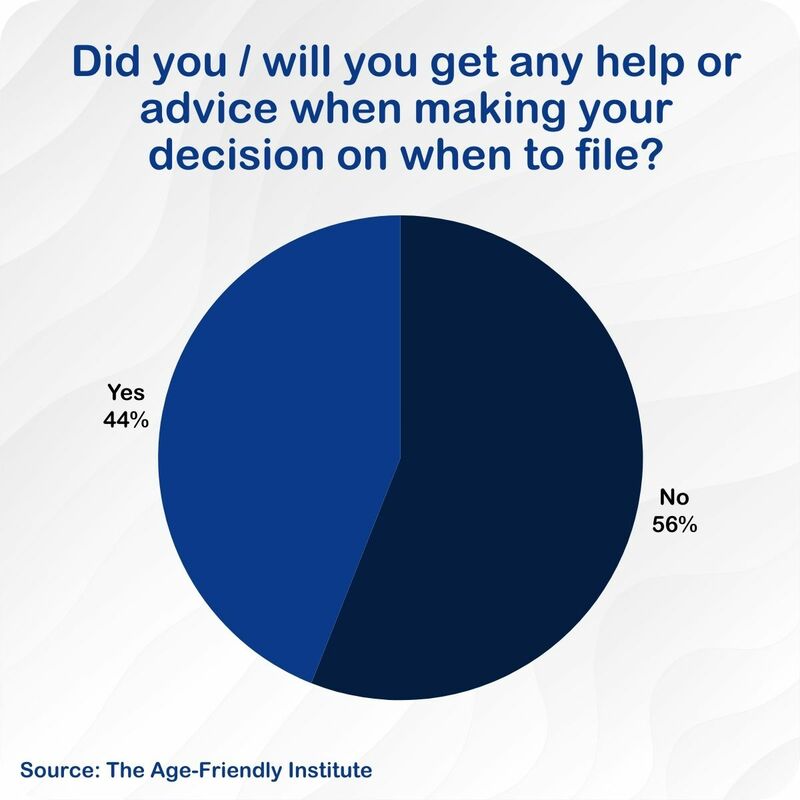

Only 44% said they got any advice on when to file and few made a financial planner (6%) or accountant (4%) their primary advisor, preferring to do their own research in making their decisions.

Studies have shown that individuals working with a financial professional often save more for retirement, experience higher returns and have increased wealth accumulation. Using a financial planner can significantly impact retirement savings in meaningful ways.

- Coming up with a customized strategy designed to meet individual needs

- Goal setting and accountability

- Ongoing monitoring and adjustment

- Optimization of investments

- Strategies for withdrawal and tax mitigation

If they could provide their younger selves with advice on retirement planning many of our survey participants referenced better savings along the way and taking advantage of IRAs and other retirement vehicles as strategies:

Start young, put anything you can away even if it is only $20/month. The "secret" is compound interest and time.

Start saving early, and take advantage of your employer's 401k, 403c, or any other savings opportunities.

Start small, but start now!

Others specifically mentioned the timing of drawing their Social Security specifically.

take social security at 70 and save more monthly

Weigh the pros and cons of when you start collecting Social Security.

If you have to rely more on social security as a primary source of income, file as late as possible. The number you see year one may seem nice/doable but by year ten is woefully inadequate because cola does not keep up with rising price as I thought it was supposed to.

take SS benefits at the latest possible age

The amount saved by filing for Social Security later depends on full retirement age and how long benefits collection is delayed. For every year an individual delays collecting social security beyond full retirement age, the benefit can increase by approximately 8% per year until age 70. This can result in a significantly higher monthly benefit, providing more financial security in retirement.

When to start collecting Social Security is a highly personal choice driven by financial needs, health, life expectancy and long term retirement plans. Having an overall financial plan and understanding the things that can impact that plan such as working while collecting social security are things that require ongoing education and effort. Whether planning for retirement, managing debt or simply trying to optimize finances a plan brings structure, discipline and peace of mind.

There are no comments for this article yet. Be the first to leave a comment